Rental Income Tax Malaysia

Alice can claim a GST credit of 2 on her activity statement and 20 as an income tax deduction on her tax return. Person who conducting business in Malaysia.

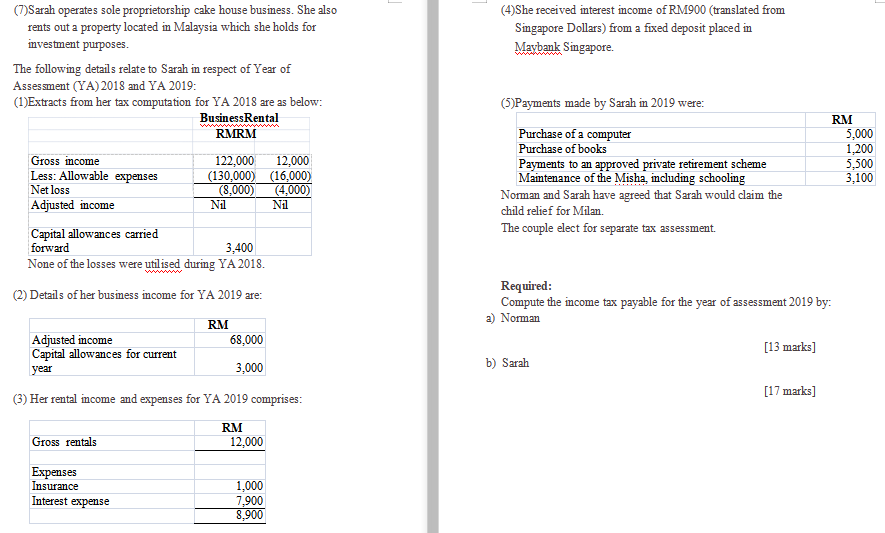

7 Rm 68 000 Adjusted Income Capital Allowances For Chegg Com

The expenses that investors can add to a cost base include but are not limited to.

. An employee is taxed on employment income earned for work performed in Malaysia regardless of where payment is made. Salaries of the employees of both private and public sector organizations are composed of a number of. Tax Offences And Penalties In Malaysia.

For small and medium enterprise SME the first RM600000 Chargeable Income will be tax at 17 and the Chargeable Income above RM600000 will be tax at 24. GST is levied on most transactions in the production process but is refunded with exception of Blocked Input Tax to all parties in the chain of production other than the final consumer. May 02 2019 at 238 pm.

If you get a larger refund or smaller tax due from another tax preparation method well refund the applicable TurboTax federal andor state purchase price paid. TurboTax Online Free Edition customers are entitled to payment of 30. Foreign income tax offset 200 Franking credit 300 Total tax payable.

Capital gains tax discount. His sister who has no other income paid only a 10 tax on the rental income. The SME company means company incorporated in Malaysia with a paid up capital of.

Title Costs such as the legal fees incurred when. How To Pay Your Income Tax In Malaysia. Purchases of books sports equipment smartphones gym memberships computers and internet subscription are allowed up to RM2500 tax relief.

You would declare your rental income pension income and shares income on your tax return. What are the Income Tax Taxation Slabs. Tax on your rental income will still need to be paid in Ireland.

CIMB Clicks is a complete one-stop financial portal offering online services such as banking insurance and share trading. End of example If youre not entitled to a GST credit claim the full cost of the business purchase including any GST as a deduction. Maximum Refund Guarantee Maximum Tax Savings Guarantee - or Your Money Back.

The capital gains tax is economically senseless. Welcome to CIMB Clicks Malaysia the online banking portal for CIMB Bank. The income is deemed as a business sources if maintenance services or support services are comprehensively and actively provided in relation to the real property.

Prior to disposal the individual derived rental income from the property and incurred interest costs in connection with borrowings to acquire the property. EFixed Return Income Account-i eFRIA-i Grow your wealth consistently with high eFixed Return Income Account-i rates Campaign Period. Non-resident employee that received payment of income.

The Assessing Officer may not allow a rent payment which is not in line with the fair market value of the premises especially when the recipient is a relative. Tax on taxable income 29467 37 x 14500 34832. Additional RM2500 tax relief for purchases of personal computers laptops smartphones and tablets made between 1 June 2020 until 31 December 2021.

The freelance calculate income tax shows the values as per these tax rates only. If you bought and sold your property within 12 months your net capital gain is simply added to your taxable income which in turn increases the amount of income tax you pay. Multiple ways are available to.

Tax Experts can prepare your tax returns and e-file. Expenses That Can be Added to the Cost Base. Incomes up to Rs 25 lakhs are not taxed upon income between the values 25 lakhs to 5 lakhs are taxed 10 5 to 10 lakhs 20 and above 10 lakhs 30.

The amount of tax is paid to the Inland Revenue Board of Malaysia IRBM. Get help on your income taxes and tax filing from us. The same taxation slabs apply to the freelancing individuals as well.

Medicare levy 134500 x 2 2690. Incidental Costs such as your rental advertisement fees legal fees and stamp duty. As for the pension this is paid to you gross but still taxable.

If you make a capital gain on the sale of your investment property you need to pay tax on this profit. Who is the payer. The existing standard rate for GST effective from 1 April 2015 is 6.

The tax traps wealth in an investment vehicle requiring special techniques to free the capital without penalty. In Malaysia income derived from letting of real properties is taxable under paragraph 4a business income or 4d Rental income of the Income Tax Act 1967. Employment income includes salary allowances perquisites benefits in kind tax reimbursements and rent-free accommodation provided by the employer.

HRA or House Rent allowance also provides for tax exemptions. The different Sections of the Income Tax Act help the salaried individuals and the self-employed people and professionals to make their rent expenditures cheaper and more desirable. The Goods and Services Tax GST is an abolished value-added tax in Malaysia.

Ownership Costs such as those incurred when searching and inspecting for properties. Valuations of some types of employment income. Who is the payee.

Withholding tax is required for payments on services rental and other use of movable property that has been given to a payee. Do i declare in Malaysia in which may required to pay tax in malaysia. This exempts income that comes from overseas like rental of property or freelance work and also remote working employees of companies that are not based in the country.

Tax On Rental Income 5 Rules You Must Know If You Rent Out Property In Malaysia

Rental Income Tax Malaysia And Other Tax Reliefs For Ya 2021

Rental Income Tax Malaysia And Other Tax Reliefs For Ya 2021

Comments

Post a Comment